Recently contradictory news were spread about heatsticks used with IQOS. We decided to understand the situation and find the answer to the public’s concern.

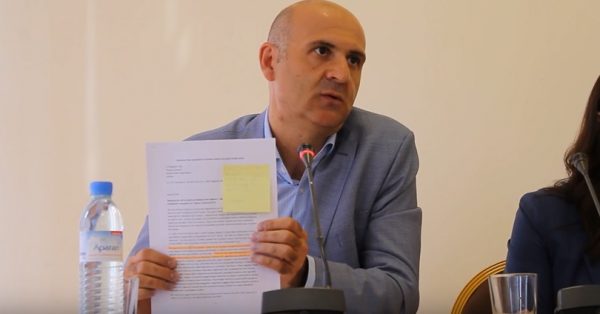

It turns out that various cigarette products, based on their nature and use characteristics, have different classifications. The traditional combustible cigarette, for example, is classified under 24.02 group and heatsticks exclusively used withIQOS are classified under 24.03 groups. At the global level, Armenia is not the only country where such a classification has been applied. To explore a deeper issue, we had a phone call with Philip Morris Armenia Manager of Corporate Affairs, Scientific Engagement and Innovations Vahe Danielyan, asking for comment. Danielyan gave the following comment on the product classification:

“Sticks containing tobacco for electrical heating, are a new product in the markets worldwide. Governments have provided customs classification overwhelmingly differentiating such sticks from cigarettes.

In response to a journalist’s question, which countries specifically gave the 24.03 classification, Danielyan replied:

“Up-to-date 40 member states of the World Customs Organization classified sticks as “manufactured tobacco not intended for smoking” including Russian Federation, Kazakhstan – who are members of the Customs Union; Ukraine and Moldova – where the product had been also launched and Italy, where the sticks imported to Armenia are being manufactured”.

In fact, the 24.03 group, among others, includes tobacco productsnot intended for smoking, such as raw materials to be used with hookah. And the heatsticks used with IQOS without combustion, are in this group as well.

The presence of tax differences between the combustible cigarettes and heated tobacco products used with IQOS is not just Armenia’s experience. As Vahe Danielyan mentioned, it is a common practice in many countries of the world.

” Moreover, tax difference between cigarettes and heated tobacco sticks for electrical heating is not unusual and reflects desire of governments to encourage smokers switching from cigarettes to the less risky alternatives…”

Continuing the study, we found out that in different countries of the world are already being considered and studied so-called risk-based taxation. The idea is that irrespective of the type of product, cigarettes, drinks, food, more risky products are taxed by a larger tax, less risky ones – smaller. Studying the international experience, it is worthwhile to come to theUK Parliament’s Science and Technology Committee recent report, in which the government is offered to give tax privileges to smok free products, such as electronic cigarette and heated tobacco devices. Moreover, returning to the peculiarities of cigarette taxation and heatsticks used with IQOS, we discovered that Kazakhstan seems to be using such an approach. Here the heatsticks are not only legally regulated, there is also zero excise tax applied on them. In other words, in terms of heatsticks, no excise taxe is required in Kazakhstan.

It turns out that the classification of heatsticks as “other non-smoking tobacco product”, as well as the difference of taxation between them andcigarettes are internationally accepted practices in many countries of the world. Along with the technological advancement, the customerdemandis being innovatively addressed, and the novel products find their own place both in custom classification and taxation.

.gif)